Tags:

zakat, islamic finance

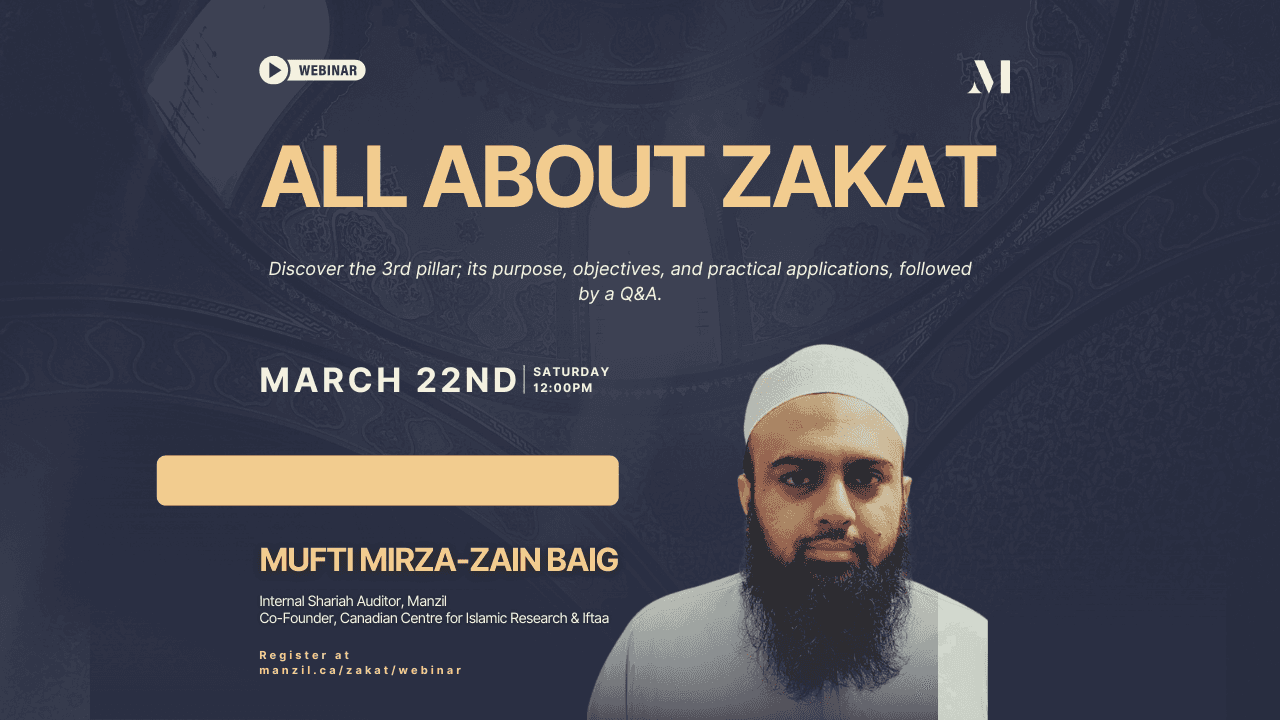

Alhamdulillah, Manzil recently hosted a powerful and educational webinar on Zakat with Mufti Mirza-Zain, Internal Shariah Auditor at Manzil and Co-Founder of the Canadian Centre for Islamic Research & Iftaa. With Ramadan’s final 10 nights upon us, the importance of giving Zakat has never been greater.

In case you missed it—or need a refresher—here’s a comprehensive recap of the key insights covered.

🕋 What Is Zakat?

Zakat literally means “to purify” and “to grow.” It’s not just a charitable donation, but an obligatory act of worship that purifies one’s wealth and soul. It is the third pillar of Islam, mentioned 32 times in the Qur’an, often alongside Salah.

💸 Defining Zakat in Practice

Zakat is:

The unconditional transfer of ownership

A prescribed amount (2.5%) of specific wealth

Given to eligible recipients as outlined in the Qur’an

Done with intentionality

🎯 Objectives of Zakat

Obeying Allah’s Command – the act itself is a direct submission to Allah (SWT).

Redistribution of Wealth – ensures wealth doesn’t concentrate among the wealthy.

Purification from Greed – it helps cleanse the heart of attachment to wealth.

Supporting the Needy – it uplifts those struggling financially.

Circulation of Wealth – fuels community and economic balance.

💼 Who Pays Zakat?

Zakat is obligatory on:

Adult Muslims (Baaligh & Sane)

Those who possess the Nisab threshold (minimum wealth) for one lunar year

The Nisab today is commonly calculated using either:

612.36g of Silver – preferred for maximizing beneficiaries

87.48g of Gold

📊 Zakat on Different Assets

Zakatable Assets:

Cash, gold/silver (including jewelry)

Business inventory

Investments (stocks, crypto, funds)

Real estate (if purchased for resale)

Non-Zakatable Assets:

Personal use property

Electronics, vehicles, and home furniture

Investments:

Traders pay Zakat on full market value

Long-term investors use a 25% proxy rule of the portfolio value, based on studies by Mufti Faraz Adam.

Manzil Investments:

Zakat applies based on the type of holding (e.g. mortgage fund units, ETFs, REITs, etc.) and whether it's a long-term or short-term investment

Zakat is not paid on CPP or funds you cannot access

🧮 How to Calculate Zakat

Total your Zakatable assets

Subtract eligible liabilities

Multiply the net amount by 2.5%

Use Manzil's Zakat calculator

Zakat becomes obligatory annually from the date you first meet the Nisab threshold. It is important to:

Set a specific date (e.g. 1st of Sha’ban)

Pay within a year to avoid sin

Make niyyah (intention) at the time of giving

👫 Who Can Receive Zakat?

To ensure it’s valid, give Zakat to:

The poor (fuqara) and needy (masakeen)

Debtors who can’t repay what they owe

⚠️ You cannot give Zakat to:

Masjid building projects

Your spouse, parents, children

Non-Muslims

Sayyids (descendants of the Prophet ﷺ)

Mufti Mirza-Zain emphasized giving to those closest to you, starting with local family and community members.

💬 Final Takeaway

Zakat is more than a number—it's a spiritual responsibility with real-world impact. The best way to fulfill it is by:

Calculating carefully

Intending sincerely

Giving responsibly

May Allah accept our Zakat this Ramadan and purify our wealth. Ameen.

Need help calculating your Zakat? Visit manzil.ca/zakat